- Wants court to force BURS to give him his tax documents to oppose P10m tax bill

- BURS refuses to return documents to Kgosi

- P10m bill effects if Kgosi fails to oppose before 8 September 2019

TEFO PHEAGE

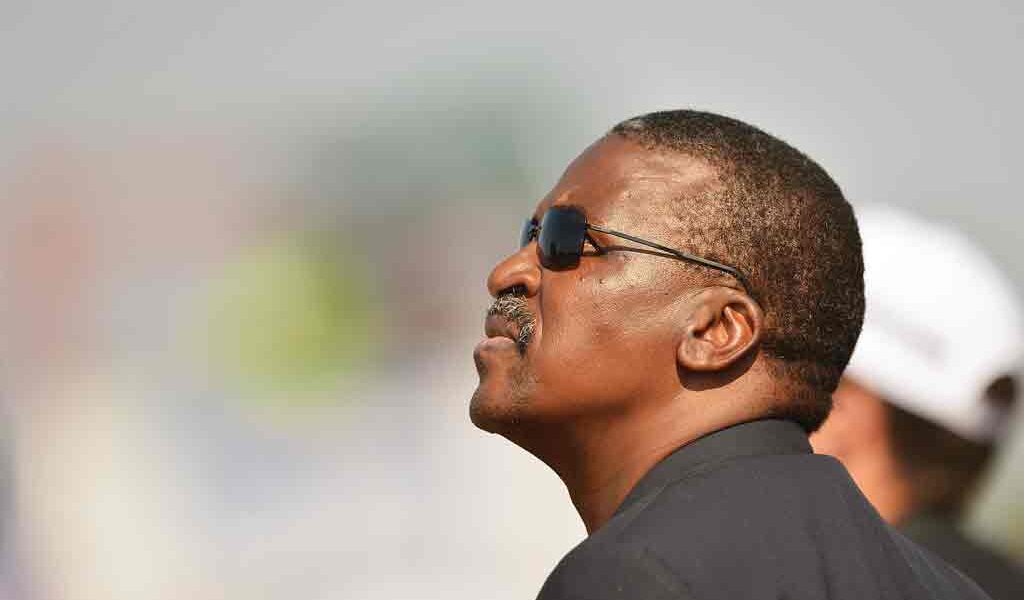

The former head of the Directorate of Intelligence and Security Services (DISS), Isaac Kgosi, has filed an urgent application with the High Court to stop Botswana Unified Revenue Service (BURS) from effecting its P10 million tax bill against him until BURS has furnished him with his tax documentation for him to oppose its bill.

BURS slapped Kgosi with a P10 million income tax bill in July after tax documents were seized from Kgosi during raids on the troubled former spy chief’s house. Kgosi’s lawyers have been struggling to get a response from the tax man who is yet to honour the former spy chief with a response.

Kgosi has requested all the documents seized from him for assessment of the claims made by BURS. His lawyer, Thabiso Tafila, has confirmed to this publication that they have written to BURS requesting more information on the claims. “It is true that we have written to them requesting that we be furnished with information regarding their claims,” Tafila said. “They have not done that.”

According to the BURS Act, if there is no opposition to a claim within a specified period, the claim is effected and the debtor loses his or her right of appeal. Kgosi’s deadline falls on 8 September 2019. This has prompted his lawyers to make an urgent application to the court to order BURS to stop effecting its charge until BURS has given them the information they need about their client.

The matter, whose date is yet to be set, will be heard at Lobatse High Court by Justice Reuben Lekorwe.

According to the BURS Act, a person dissatisfied with a decision under Section 30 (5) of the VAT Act may within 30 days after receiving a notice of the decision, lodge with the Commissioner General a notice of appeal to the High Court or the Board of Adjudicators. The law further says any person dissatisfied with the Commissioner General’s decision may by notice in writing appeal to the High Court or to the Board of Adjudicators within 60 days after receiving a notice of the decision.

The notice of appeal shall be in writing, state whether the appeal is to the High Court or the Board of Adjudicators, must be restricted to the grounds in the objection given to the Commissioner General and must contain an address for service of notice of the date and place of hearing.

The Commissioner General or Kgosi may appeal to the High Court from any decision of the Board of Adjudicators which involves a question of law, including a question of mixed fact and law. The Commissioner General or Kgosi may also appeal to the Court of Appeal as of right now from any decision of the High Court which involves a question of law, including a question of mixed fact and law

The Commissioner General may either allow the objection in whole or in part or disallow the objection, and he shall serve Kgosi with notice in writing of the decision on the objection and if the Commissioner General’s decision is a reduced assessment, he shall issue a notice of reduced assessment to Kgosi, together with the notice of his decision.