A new report from the Global Financial Integrity network shows that Botswana lost over P73,97 billion from 2009 to 2013, in illicit financial flows. The country rankings for the years under review show that Botswana came 66th in the world and 14th in Africa, in terms of quantities of lost development money due to trade mis-invoicing, transfer mispricing by companies with subsidiaries domiciled in low tax jurisdictions and hot money flows.

Money launderers, corrupt politicians, terrorists, arms traffickers, drug smugglers, and tax evaders, in moving their dirty money, all rely on company structures that allow them to hide their identity, and banks and other professionals willing to do business with them, both who are currently all-too available in jurisdictions termed “tax havens”.

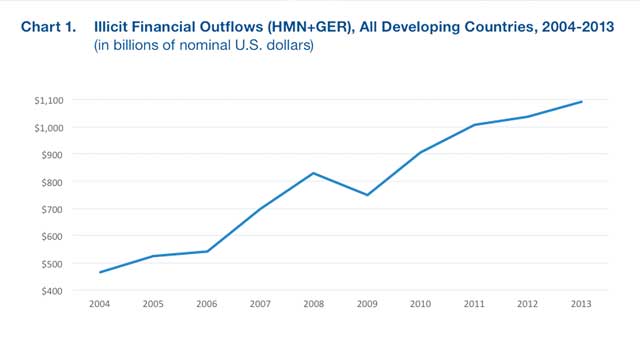

The report titled Illicit Financial Flows (IFFs) from Developing Countries 2004-2013, shows how Botswana and other developing and emerging economies lost a cumulative US$780 billion (P7.8 trillion) illicit financial flows from 2004 through 2013, with illicit outflows increasing at an average rate of 6.5 percent per year—nearly twice as fast as global GDP.

In analysing IFFs, GFI utilised sources of data and analytical methodologies used by international institutions, governments, and economists for decades; the data sources and methodologies provide information on gaps in balance of payments data and gaps in trade data.

Where recorded sources and uses of funds in balance of payments data do not match, the difference is net errors and omissions indicating unrecorded inflows or outflows of money. Where bilateral trade data does not match, after adjusting for freight and insurance in the data of the importing country, this indicates re-invoicing of transactions between export from one country and import into another country. The general manager at the High Tax Payer’s Unit of the Botswana Unified Revenue Services (BURS), William Nkitseng, recently told this publication that issues of transfer pricing are still new globally and in Botswana in particular, leaving some legal loopholes.

“The law states that transactions between related parties must be done at arm’s length; but multinationals come from jurisdictions that have tightened their laws and when they see loopholes here, they will use them,” said Nkitseng. Nkitseng said the Organisation for Economic Co-operation and Development is assisting BURS to come up to speed in dealing with the most sophisticated forms of tax evasion which deprives countries development money.

Average of illicit flow losses per year is P13,68 billion. The Ministry of Education and Skills Development received P10.31 billion and the Ministry of Health budget was P5.67 billion