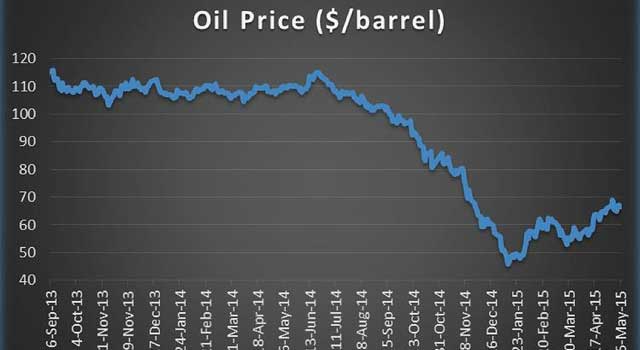

Global crude oil prices hit the highest point of $68.99 per barrel on Wednesday, May 06 since dropping to an all-time low of $42 early this year. Prices have hovered consistently around the $50 mark ever since and recently they have crossed over $60 per barrel.

Analysts have attributed the dramatic fall in prices to a deliberate move by Saudi Arabia for an oil price crush in response to threats posed by new forms of renewable energy — windmills, tidal power, and solar power. The Saudis also wanted to keep in check fracking in the United States which threatened to displace their production. One analyst, Philip Verleger, an economist and consultant who has watched the oil market for more than 40 years, has argued; “Saudis now want cheaper oil, in part to slow down the fracking revolution in the U.S. — and to signal to the developing world: Don’t worry — you don’t need to invest in alternative energy. You can buy cheap oil from us.”

It seems oil prices are popping back up, what could be the cause? Tlotlo Ramalepa, an analyst at Motswedi Securities, says supply and demand factors were at play in this price movement. “Recent instabilities in oil producing countries of Yemen and Libya led to an expectation of an oil supply shortfall, hence the rise in prices,” explained Ramalepa. Batsumi Rankokwane, Principal Energy Officer in the Ministry of Minerals, Energy and Water Resources, corroborated Ramalepa, “The recent gain in oil prices is as a result of instabilities in the Arab countries, Yemen, Syria and Libya. These countries are oil producers and the instability has negative impact on oil production and supply, hence a rise in oil prices. Data coming from the US in recent times have shown that the number of oil drilling rigs has gone down and this fuelled expectation of a decline in US production. Therefore, the main drivers have been around geopolitics and speculation.”

Gazette Business asked Rankokwane what the implication of rising oil prices is for Botswana, and he responded, “Botswana as a price taker is obviously affected by the increase in international crude oil prices as this translates to an increase in prices of petroleum products.” He pointed out that The National Petroleum Fund (NPF) will continue to be used to cushion local fuel prices as well as fund other obligations such as development of strategic storage facilities. Quizzed if we should expect a fuel pump price increase soon, or if the NPF had sufficient funds to cushion us, Rankokwane said they continue to review petroleum product prices on a monthly basis, and if any decision is arrived at on whether there will be petroleum product price adjustment or not will be communicated at the appropriate time.

Ramalepa, however, played down the possibility of a fuel pump increase saying the recent increase in crude oil prices was insignificant. “Mid-2014, crude oil cost over $110 per barrel, now it’s selling at around $65, it has almost halved. Unless prices jump to over a $100 per barrel, I don’t think there could be fuel pump price increase,” said Ramalepa. Gazette Business asked Ramalepa if the increase in global crude oil prices will continue. “It’s difficult to predict. Just two months ago, no one knew they would be war in Yemen which is now threatening an oil supply shortfall,” he responded. Verleger, however, says he expects to see prices back down around $50 by the end of the year.