- Allegedly more than P100m transferred to Canada

- Likely to face money laundering and tax evasion charges

- Plot to eliminate key state witnesses thickens

LETLHOGILE MPUANG

A local Chinese businessman named Jian Liu could soon be shown an P80 million tax bill by the Botswana Unified Revenue Services (BURS) after he allegedly stashed P100 million away in Canada, The Botswana Gazette has established.

This publication understands that the taxman is edging closer to completing investigations into Liu’s company, Sunshine Construction. So far preliminary investigations have revealed that the company made several false tax declarations between 2010 and 2018. In the process, over P100 million was transferred to a bank account in Canada where his family is said to be residing. He is also believed to have invested in property in both Canada and New York, USA.

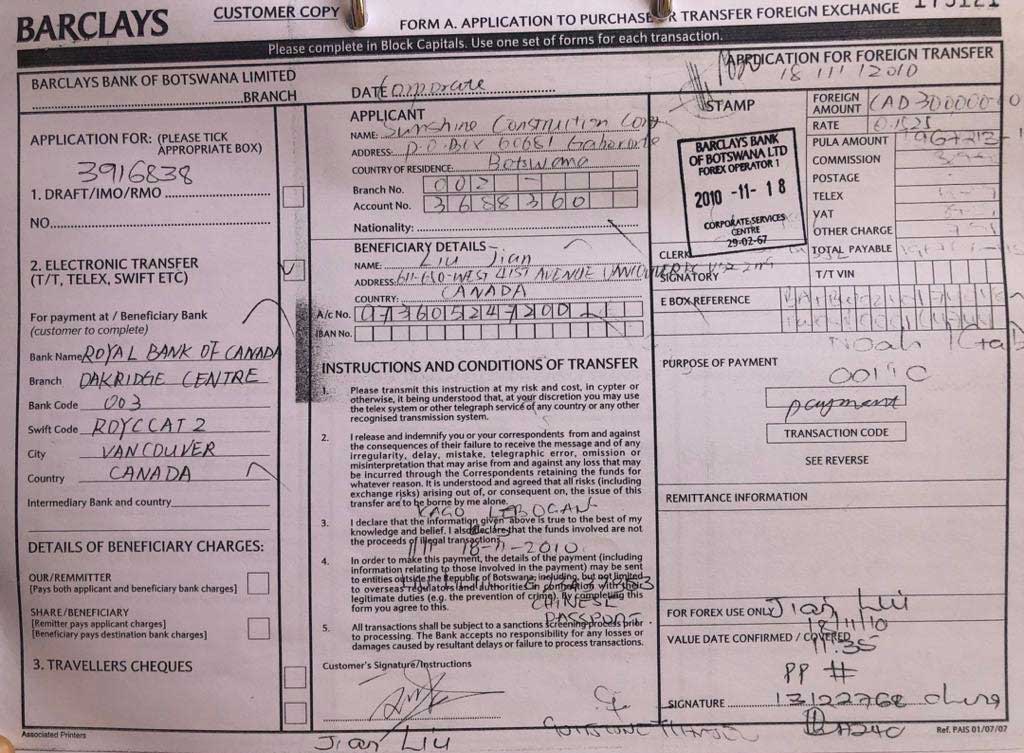

Financial transactions seen by The Botswana Gazette show that in 2010, Sunshine Construction company accounts held at Banc ABC, FNB, Stanbic Bank and Barclays Bank were used to transfer more than P10 million to Royal Bank of Canada (Swift Code) ROYCAT2, Vancouver, Canada, account. In the same year, the company only paid P9750 in tax returns based on declared income of P114 000. The trend continued for years while millions upon millions of pula were continuously moved to the same account in Canada.

The taxman is also said to have established that the company had several contradictory financial results. Sources reveal that BURS has to this point established that the company owes P80 million in tax, including accumulated interest.

BURS General Manager (responsible for) Investigations, Compliance and Enforcement (ICE), Kaone Molapo, was unavailable for comment at the time of going to press. Liu did not respond to this publication’s enquiry sent to him on Monday evening. His phone also rang unanswered throughout.

Liu and his company were raided by BURS in March. He was found to be in possession of more than a million pula in hard cash. He is likely to face charges of money laundering, tax evasion and falsifying invoices. His construction company has seen a great deal of government business over the years.

KEY STATE WITNESSES RISK DEPORTATION

Meanwhile, The Botswana Gazette understands that two key state witnesses in this case could be deported allegedly to weaken Liu’s prosecution. According to sources, Liu is accusing his former employees of misappropriation of his company’s funds. The Criminal Investigations Department (CID) are said to have begun investigating the two employees.

In March, this newspaper reported that there was a possible plan to thwart these investigations to ultimately kill the case. It is understood that a certain immigration official was under investigation in connection with this plot. The official, whose names are known to this publication, is said to have revoked the work and residential permits of one of these two men linked to Liu after they fell out with him.

It is said one the two, who is also a Chinese national, has threatened to report a whole lot of illegal dealings involving Liu. The Botswana Gazette is in possession of copies of some of the transactions that are under investigation.