Last week this paper uncovered a potential partnership between ReconAfrica and the government of Botswana despite experts warning that there is no oil in northern Botswana. While government mulls this partnership with the Canadian oil company, evidence suggests that ReconAfrica could be a potential petroleum pump and dump scheme aimed at defrauding investors.

Pump and dump

A pump and dump scheme is a securities fraud which involves exaggerating the value of stocks through misleading positive statements and publications. In the case of ReconAfrica, this would involve misinterpreting and manipulating data from test wells in Namibia to boost share values before offloading stocks to make huge profits.

Transactions on the Canadian stock exchange are public record and can be accessed online. Over the past 12 months, ReconAfrica directors have sold company shares (publicly traded as RECO) for significant profit. Nicholas Steinsberger (Senior Vice President, Drilling and Completions) sold 122,000 shares, Anna Tudela (Corporate Secretary and Chief Compliance Officer) sold 92,206 shares, Carlos Escribano (Chief Financial Officer) sold 85,000 shares, Ian Telfer (Director of Renaissance Oil that purchased a 50% interest in profits generated from the Botswana lease) sold 71,732 shares, James Wilton Granath (Independent Director of Reconnaissance Energy Africa) sold 40,000 shares, Scot Evans (CEO of ReconAfrica and Director of Reconnaissance Energy Botswana) sold 35,000 shares in the company, and Gordon Keep (Independent Company Director) sold 18,748 shares. Every single registered share sale over the past 12 months has been sold by a director of ReconAfrica.

In 2019 RECO shares were valued at $0.25. Following their claims of a significant oil discovery in Botswana and Namibia, RECO shares hit a high of $11.74 in July 2021. The offloading of these RECO shares would have netted ReconAfrica company directors millions of USD.

Frederick M. Lehrer, a former US based SEC enforcement attorney who has more than 20 years’ experience in corporate finance and securities law, told National Geographic that “the big question for investors is why insiders were secretly selling their shares while promotional materials touted the company’s prospects.”

As a result, ReconAfrica is currently under a class action lawsuit in the US where plaintiffs from the Eastern District of New York claim that the 1,600% increase in ReconAfrica stock prices over the past 12 months is based on a concerted campaign of paid stock promotion and opaque press releases aimed at unsophisticated investors.

Erica Lyman is a Professor of global law at the Lewis & Clark Law School in the US. She explains that, “Petroleum pump and dump schemes are a legitimate concern and they can come with real financial costs to investors, including government partners, when the promised returns never materialize and share prices crash.”

How much is it worth?

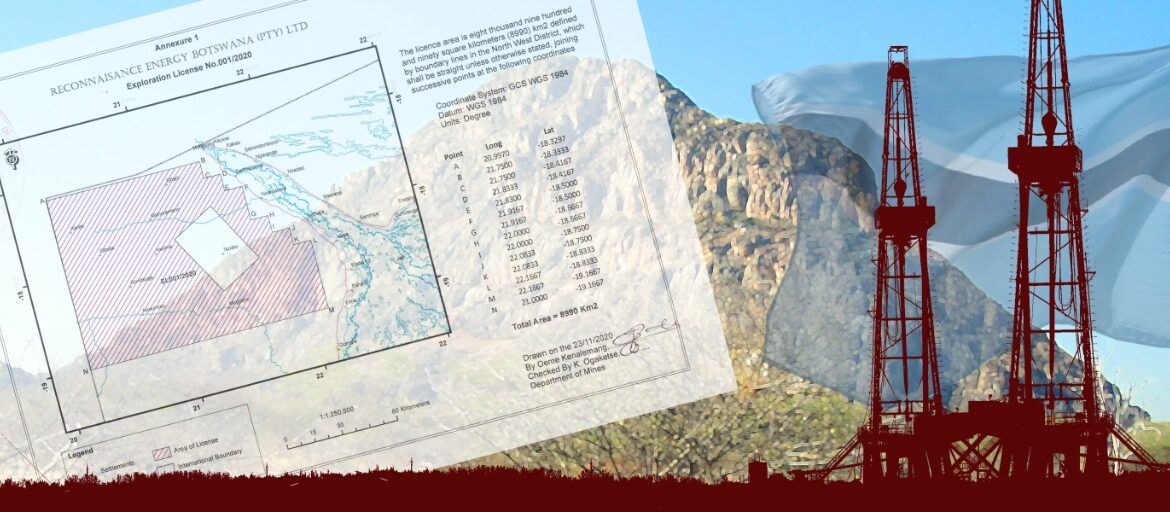

Craig Steinke, Executive Chairman of ReconAfrica, purchased the Botswana exploration lease for P69,447, renewable on an annual basis. In a complex series of transactions that followed, it appears that Steinke sold an option for 100% of the working interest of the lease to ReconAfrica for 30 million shares in the company. Fifty percent of the exploration license was then acquired by Renaissance Oil. Renaissance Oil, owned by Craig Steinke, was then acquired by Reconnaissance Energy Corp for a reported $155 million USD. As of September 2021, ReconAfrica published a Consolidated Interim Financial Statement where the company valued the Botswana lease at just over $105 million USD, having never completed a single exploration test on within the lease area.

Government partnership

It is unclear how a potential partnership between the Ministry of Minerals through Botswana Oil Limited and ReconAfrica would be structured, but it would likely be based on a purchase of shares using taxpayer money based on ReconAfrica’s market value of the exploration lease according to a legal source. The Ministry refrained from addressing this point directly when questioned, and only commented that the lease “makes a provision for the Minister to enter into an agreement with any person in respect of the conditions to be included in a licence. In accordance with this, developments and discussions around the exploration project will determine the relationship and or partnerships that may result.”

A partnership with government would provide ReconAfrica with further credibility boosting their share value even further. Erica Lyman explains that “Government partnerships provide legitimacy and an air of inevitable success. In a traditional pump and dump scheme, this would help raise stock prices and potentially enrich insiders, while the government’s reputation as a steward of taxpayer money could be in ruins.”

An investigation group called Viceroy speculates that owing to ReconAfrica’s misinterpreted test well findings and clear stock manipulation; within two years the company directors will have fled with substantial earnings leaving the company a hollow shell and the RECO shares an unimpressive penny stock.