- Says VAT is not the only answer to declining revenues and COVID-19 scourge

MPHO MATSHEDISO

Following the announcement by the Minister of Finance and Economic Development, Dr. Thapelo Matsheka in this year’s budget speech that there will be a 2 percent VAT increase to 14 percent, the government is set to generate over 1.3 billion in revenue, The Botswana Gazette has established.

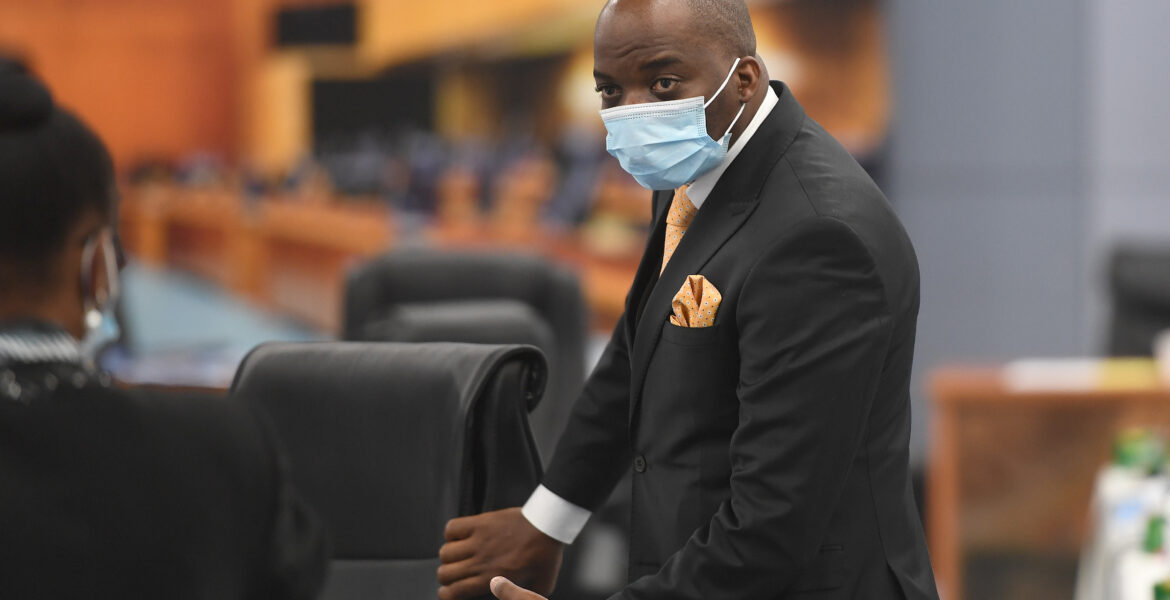

Responding to the VAT bill that effected on 1 April, the MP for Selibe-Phikwe West, Dithapelo Keorapetse, commented: “VAT is not the answer to the state of declining revenues and the COVID-19 scourge as it further empties the pockets of Batswana. It is important to ensure efficiency and effectiveness in collection of government revenues, hence strengthening the Botswana Unified Revenue Service (BURS) should be prioritized.”

“The Ministry of Finance should also consider legislative improvements to deal with transfer pricing and collection of donations and inheritance tax. There are problems with implementation of the Inheritance Tax because there are insufficient information and control mechanisms to monitor Inheritance Tax transactions.”

Keorapetse said transfer pricing is unfairly regulated in Botswana. “There is no way BURS verifies the true value of goods and services rendered, for instance, when a big corporation buys and uses services from many companies owned and controlled by its directors.”

He called the supplementary budget of P172 million proposed by the finance minister “colossal” because supplementary budgets are meant for emergency financial situations. “There is need for a parliamentary budget office to assist (and) effectively scrutinize the budget,” he said.

He also appealed to his fellow MPs to formulate policies that include the shaping of the budget and the civil service, as well as other state institutions like the police and the military. “The bureaucracy (is) encouraged by political heads in the finance ministry (to) influence our budget with Parliament playing a minimal role,” Keorapetse said.