GAZEETE REPORTER

Minergy is no longer accepting orders after the company was flooded with demand for coal from industrial and power generation markets to secure supply (locally and internationally) that exceed its production capacity, says the CEO, Morne du Plessis.

“Our strategy nevertheless remains to operate at full production capacity to maximise sales,” he notes in the company’s Integrated Annual Report 2022 released recently.

Full capacity

“The boom experienced in the coal market worldwide has allowed Minergy to position itself to mine and produce at full production capacity, which up until end quarter 3 (Q3) had to be managed within the confines of slowing demand experienced in early 2022, inventory build-ups and plant limitations.

“Capacity was ramped up late in the fourth quarter, which included mobilising additional mining fleet and securing critical spares.”

Du Plessis says full capacity was achieved by end July 2022 and has been maintained since.

“Unfortunately, the energy supply crisis also significantly negatively impacted Minergy’s cost structure, especially the cost of diesel and explosives, as well as functioning in hyperinflationary environments,” he points out. “Local consumer price inflation has also risen sharply, stemming from the above.”

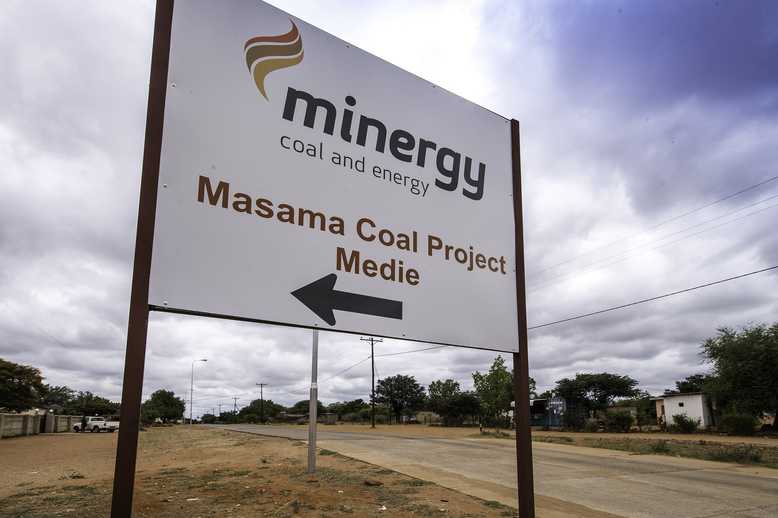

Du Plessis says Minergy, which runs Masama Coal Mine, is executing a business plan aligned to capitalising on the unique opportunity presented by the current extraordinary energy shortages and the global realisation that dependence on a single energy source is risky.

Coal’s advantage

“This has worked to coal’s advantage, given that it is a plentiful and reliable source of energy, and coal has re-emerged as a result,” he notes.

“Strong relationships with traders and end customers have been forged during this time, which should bode well for future demand.”

The Minergy CEO says the opportunity exists to maintain full production capacity and sell products at optimum prices.

“It follows that this will translate into profitability and stable cash flows, ensuring sustainability, decreasing the dependence on debt, and increasing the ability to operate within the realm of positive cash flows,” he states in the report.

Strong market

“Based on interaction with customers and other industry stakeholders, Minergy believes that the strong market for coal will remain at least for the ensuing financial year, if not longer.”

Du Plessis used the report to note that Minergy was invited to tender for a new 300MW (net) coal-fired power plant in Botswana, the only bidder with an operational coal mine.

“The tender was submitted on 27 April 2022 alongside two other competitive bids,” he says. “Announcements regarding the outcome will be made in due course.”