Part One-The Rationale of BRICS

DOUGLAS RASBASH

The subject of BRICS has become very compelling to many in Africa and across the globe. BRICS being a strategic alliance of five great nations, Brazil, Russia, India China and South Africa. These nations will meet for the eighteenth time in Sandton South Africa from the 22nd to 24th August 2023. This exclusive and in-depth feature is intended to provide the context for the summit – especially the hotly debated proposed BRICS currency.

Brick in the Wall

The phrase “Another Brick in the Wall” is derived from the iconic song “Another Brick in the Wall (Part II)” by the British rock band Pink Floyd. The song was released in 1979 and became a symbol of rebellion and critique of the education system and societal conformity. In the context of the song, “Another Brick in the Wall” represents the idea of individuals being moulded into conformist and homogeneous members of society, losing their individuality and creative expression. It symbolizes the oppressive forces that suppress individuality, critical thinking, and personal freedom. The lyrics of the song, particularly the refrain “We don’t need no education, we don’t need no thought control,” express a rebellion against the rigid structures and norms imposed by institutions, urging people to break free from the metaphorical walls that constrain them. The phrase “Another Brick in the Wall” has since gained broader usage beyond the song, often used metaphorically to describe situations where individuals or groups feel trapped, conforming to societal expectations, systems, or institutions. It represents the struggle for individuality, freedom of expression, and the desire to challenge established norms. In the context of a feature titled “Another BRIC in the Wall,” it seems to suggest a connection between the aspirations and challenges of the BRICS countries and the rebellious spirit of the song. It implies that the BRICS nations are striving to break free from existing structures, create their own path, and overcome obstacles as they seek to establish alternative to the USD status quo. Another BRIC in the Wall” does seem to capture the sentiment of the BRICS nations seeking to establish their own identity and challenge the dominance of the US dollar in the global economy. It suggests that the BRICS countries are looking to break free from the existing global economic order, represented metaphorically as a wall built by the USD-led system.

Alternative framework

The phrase implies that the BRICS nations, as emerging economies with significant influence, are striving to create an alternative framework that aligns with their own interests and aspirations. It suggests a desire to reduce their dependence on the US dollar and reshape the global economic landscape, highlighting the need for diversity and greater autonomy in international finance. By using a play on words from the famous Pink Floyd song, the title underscores the rebellious spirit of the BRICS nations as they challenge the existing system and aim to establish their own presence in the global economy.

New BRICS currency

Due to the massive interest and importance in this topic the Gazette has prepared a four-part series where the author explores the rationale, risks and uncertainties of a new BRICS currency the prerequisites for its success and the example of the Euro, look at each of the BRICS+ countries basic fundamentals and in the final fourth part what might be the advantages and disadvantages for Botswana to join it.

BRIC concept

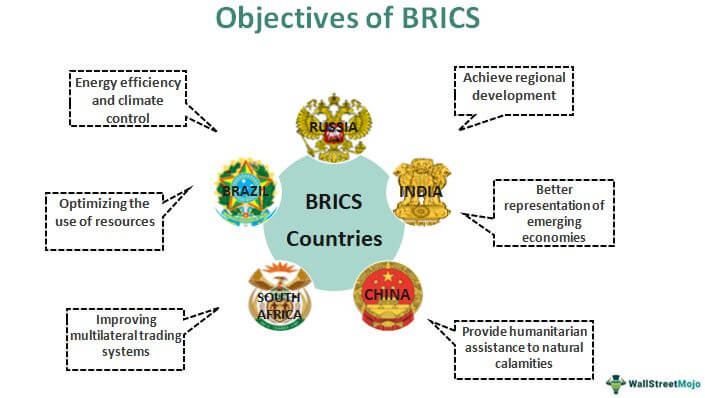

“BRIC” was coined in 2001 by economist Jim O’Neill, then at Goldman Sachs Group Inc., to draw attention to strong growth rates in Brazil, Russia, India and China. It was intended as an optimistic thesis for investors amid market pessimism following the terrorist attacks in the US. South Africa was added subsequently to that BRICS is an acronym for Brazil, Russia, India, China, and South Africa. BRICS works on the principles of non-interference, equality, and mutual benefit. The alliance is economic, territorial and resolves political disputes. Three pillars of BRICS are – political and security, economic, financial, and cultural and people to people exchanges. Accounting for 23 percent of the global economy, 18 percent of trade in goods and 25 percent of foreign investment, BRICS countries have formed an important force that cannot be ignored in the world economy. What should be of concern is continued dominance of one country, the lack of mutual economic interests, competition among themselves and cultural differences. Will the BRICS countries seek to establish a parallel system with its own distinctive set of rules, institutions, and currencies of power, rejecting key tenets of liberal internationalism, or will they seek to embrace the rules and norms that define today’s Western-led order? Consequently, the broader issue is that the BRICS as an organisation still lacks deeper institutionalisation. Beyond the establishment of the NDB, ‘it is difficult to see what the group has done other than meet annually’ (O’Neill, 2021). This problem is compounded by the fact that economic growth trajectories have been so uneven, and the group lacks clear unifying ideological principles or a shared vision for managing the global order. This is evident in the ‘ambivalent’ way that China and India are torn between their self-identity as developing countries, with a purported mission to lead the Global South, and the unavoidable reality that their economic interests increasingly align with the Global North. The decision to expand the alliance will be jointly taken in the next BRICS summit and the bloc could soon become BRICS+. The total number of countries that could challenge the U.S. dollar on the global stage has reached forty-one.

Establishing a BRICS currency

Establishing a BRICS currency

Let us consider the rationale for establishing a BRICS currency. A common currency could promote deeper economic integration among BRICS nations by facilitating trade and investment. It would eliminate currency exchange costs and reduce transactional barriers, potentially leading to increased economic cooperation and development. The BRICS nations, being major emerging economies, often face challenges due to the dominance of the US dollar in global trade and finance. A unified currency could potentially reduce reliance on the US dollar, enhancing their economic independence and stability. The creation of a common currency could enhance the collective influence of BRICS nations on the global stage. It could provide a platform for collaboration, joint decision-making, and a stronger voice in global financial institutions.

Pros

The potential Pros of a BRIC Currency include firstly the establishment of a common currency that could simplify trade and investment processes, reducing transaction costs, currency risks, and exchange rate volatility. This could boost intra-BRICS trade and attract foreign investment to the region. Secondly a shared currency would necessitate closer monetary policy coordination among BRICS nations, enabling them to harmonize their policies and respond collectively to economic challenges. This could contribute to macroeconomic stability and regional financial resilience. Thirdly a unified currency may lead to increased financial integration among BRICS nations, promoting the development of regional financial markets, investment opportunities, and cross-border capital flows.

Cons

The potential cons of a BRIC Currency include firstly concern the lack of economic heterogeneity, BRICS nations have diverse economic structures, growth rates, and policy priorities. Establishing a common currency would require significant convergence of their economic systems, which could be challenging due to inherent disparities. Secondly there will be loss of monetary autonomy because adopting a shared currency would entail relinquishing independent monetary policies. It could limit a country’s ability to respond to domestic economic conditions, potentially creating tensions and imbalances within the BRICS group. Thirdly there will almost certainly be political complexities, because designing and implementing a new currency requires political will, consensus-building, and coordination among member nations. Negotiating issues such as exchange rate regimes, governance structures, and distribution of costs and benefits could be complex and time-consuming.

It’s important to note that the establishment of a new currency like the BRIC would involve extensive analysis, negotiations, and considerations of various factors specific to the BRICS nations’ economic and political contexts. This response is based on a hypothetical scenario, and it is advisable to seek up-to-date information to understand any recent developments regarding the BRICS group. In part two we consider how the BRIC may work and the impact of the Euro on the global economy which also had an intention of countering dollarisation.