- Only citizen employees qualify

- Employers should be registered with BURS at least for income tax

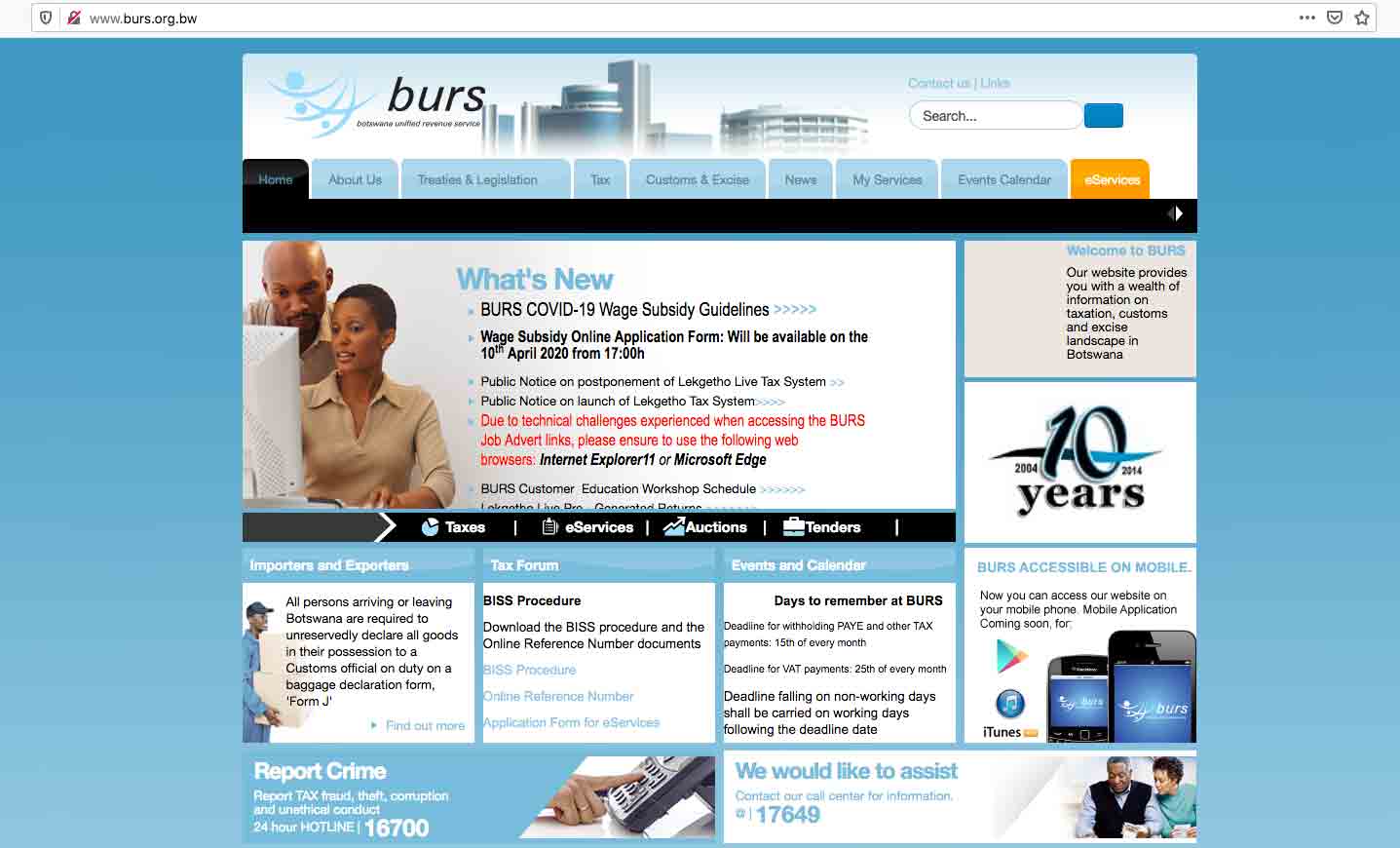

To access a share of the P1 billion COVID-19 wage subsidy fund, qualifying businesses should complete a relevant form that is available on the BURS website and submit it online.

According to Botswana Unified Revenue Service, only citizen employees qualify for this subsidy. Employers in selected sectors and registered with BURS at least for purposes of income tax qualify but will be expected to make a commitment not to retrench any employees because of COVID-19.

In addition, employers will have to produce proof of their wage bills from December 2019. BURS says the subsidy will begin in April and end in June 2020. According to BURS, companies not registered with the tax authority but want access to the fund must first register for income tax at the BURS e-service portal.

Parastatals, quasi- government institutions, NGOs, food retailers and wholesalers, post and communications companies, as well as banks and insurance companies do not qualify for assistance under the wage subsidy fund. Pension fund administrators, stock exchanges, fund managers, medical aid companies and phamaceuticals are also excluded. The subsidy is being offered under the Public Finance Management Order 2020.